pool ads

pool ads(WFRD) Pivots Trading Plans and Risk Controls

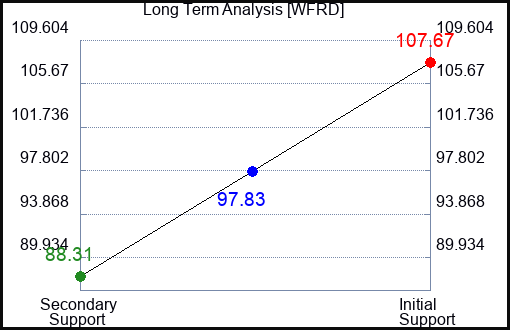

Longer Term Trading Plans for WFRD

Swing Trading Plans for WFRD

- Buy WFRD slightly over 101.29, target 105.08, Stop Loss @ 101

- Short WFRD slightly near 101.29, target 97.83, Stop Loss @ 101.58.

Day Trading Plans for WFRD

- Buy WFRD slightly over 99.8, target 101.29, Stop Loss @ 99.57

- Short WFRD slightly near 99.8, target 97.83, Stop Loss @ 100.03.

Check the time stamp on this data. Updated AI-Generated Signals for Weatherford International Plc (WFRD) available here: WFRD.

WFRD Ratings for December 29:

| Term → | Near | Mid | Long |

|---|---|---|---|

| Rating | Strong | Strong | Strong |

| P1 | 0 | 0 | 88.31 |

| P2 | 99.8 | 101.29 | 97.83 |

| P3 | 102.55 | 105.08 | 107.67 |

AI Generated Signals for WFRD

Blue = Current Price

Red= Resistance

Green = Support

Real Time Updates for Repeat Institutional Readers:

- Factset: Request User/Pass

- Bloomberg, Reuters, Refinitiv, Zacks, or IB users: Access Here.

Instructions:Click the Get Real Time Updates button below.

In the login prompt, select forgot username

Type the email you use for Factset

Use the user/pass you receive to login

You will have 24/7 access to real time updates.

Click the Get Real Time Updates button below.

In the login prompt, select forgot username

Type the email you use for Factset

Use the user/pass you receive to login

You will have 24/7 access to real time updates.

From then on you can just click to get the real time update whenever you want.

Our Market Crash Leading Indicator isEvitar Corte.

Evitar Corte warned of market crash risk four times since 2000.

It identified the Internet Debacle before it happened.

It identified the Credit Crisis before it happened.

It identified the Corona Crash too.

See what Evitar Corte is Saying Now.

Get Notified When our Ratings Change:Take a Trial

This Weatherford International Plc (NASDAQ: WFRD) report was produced by Stock Traders Daily. Over the past 20 years our metholdology has been refined to help identify strategies for both individual stocks and the stock markets, with prudent risk controls.

Warning:

This is a static report, the data below was valid at the time of the publication, but support and resistance levels for WFRD change over time, so the report should be updated regularly. Real Time updates are provided to subscribers. Unlimited Real Time Reports.

Subscribers also receive market analysis, stock correlation tools, macroeconomic observations, timing tools, and protection from market crashes using Evitar Corte.

Instructions:

The rules that govern the data in this report are the rules of Technical Analysis. For example, if WFRD is testing support buy signals surface, and resistance is the target. Conversely, if resistance is being tested, that is a sign to control risk or short, and support would be the downside target accordingly. In each case, the trigger point is designed to be both an ideal place to enter a position (avoid trading in the middle of a trading channel), and it acts as a level of risk control too.

Swing Trades, Day Trades, and Longer term Trading Plans:

This data is refined to differentiate trading plans for Day Trading, Swing Trading, and Long Term Investing plans for WFRD too. All of these are offered below the Summary Table.

Instructions:

The rules that govern the data in this report are the rules of Technical Analysis. For example, if WFRD is testing support buy signals surface, and resistance is the target. Conversely, if resistance is being tested, that is a sign to control risk or short, and support would be the downside target accordingly. In each case, the trigger point is designed to be both an ideal place to enter a position (avoid trading in the middle of a trading channel), and it acts as a level of risk control too.

Swing Trades, Day Trades, and Longer term Trading Plans:

This data is refined to differentiate trading plans for Day Trading, Swing Trading, and Long Term Investing plans for WFRD too. All of these are offered below the Summary Table.